With 70% possession, Corning Included (NYSE:GLW) boasts of robust institutional backing

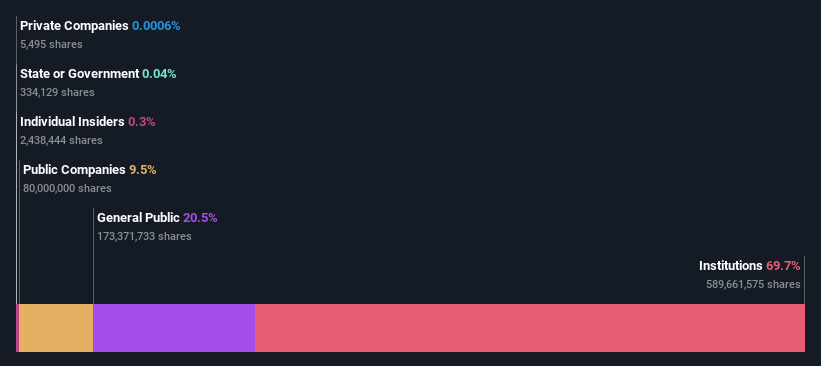

If you wish to know who actually controls Corning Included (NYSE:GLW), then you definately’ll have to have a look at the make-up of its share registry. We are able to see that establishments personal the lion’s share within the firm with 70% possession. In different phrases, the group stands to realize essentially the most (or lose essentially the most) from their funding into the corporate.

As a result of institutional homeowners have an enormous pool of sources and liquidity, their investing selections have a tendency to hold an excessive amount of weight, particularly with particular person traders. Due to this fact, a very good portion of institutional cash invested within the firm is often an enormous vote of confidence on its future.

Within the chart under, we zoom in on the completely different possession teams of Corning.

View our newest evaluation for Corning

What Does The Institutional Possession Inform Us About Corning?

Institutional traders generally evaluate their very own returns to the returns of a generally adopted index. So they often do think about shopping for bigger corporations which can be included within the related benchmark index.

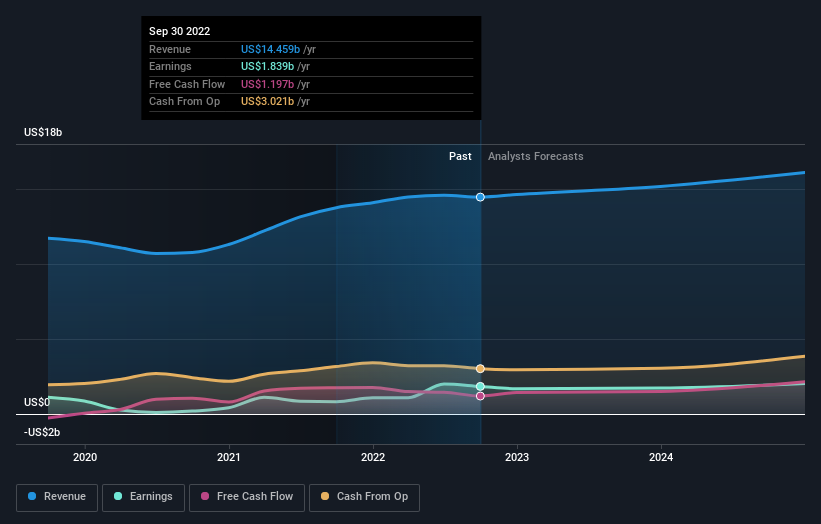

We are able to see that Corning does have institutional traders; they usually maintain a very good portion of the corporate’s inventory. This suggests the analysts working for these establishments have seemed on the inventory they usually prefer it. However similar to anybody else, they could possibly be fallacious. When a number of establishments personal a inventory, there’s all the time a danger that they’re in a ‘crowded commerce’. When such a commerce goes fallacious, a number of events could compete to promote inventory quick. This danger is larger in an organization with out a historical past of progress. You may see Corning’s historic earnings and income under, however bear in mind there’s all the time extra to the story.

Buyers ought to be aware that establishments really personal greater than half the corporate, to allow them to collectively wield important energy. Corning is just not owned by hedge funds. The Vanguard Group, Inc. is at the moment the most important shareholder, with 11% of shares excellent. In the meantime, the second and third largest shareholders, maintain 9.5% and 6.6%, of the shares excellent, respectively.

Trying on the shareholder registry, we are able to see that fifty% of the possession is managed by the highest 16 shareholders, that means that no single shareholder has a majority curiosity within the possession.

Researching institutional possession is an effective solution to gauge and filter a inventory’s anticipated efficiency. The identical will be achieved by finding out analyst sentiments. Fairly just a few analysts cowl the inventory, so you can look into forecast progress fairly simply.

Insider Possession Of Corning

The definition of firm insiders will be subjective and does fluctuate between jurisdictions. Our knowledge displays particular person insiders, capturing board members on the very least. The corporate administration reply to the board and the latter ought to characterize the pursuits of shareholders. Notably, generally top-level managers are on the board themselves.

Most think about insider possession a constructive as a result of it may possibly point out the board is properly aligned with different shareholders. Nevertheless, on some events an excessive amount of energy is concentrated inside this group.

Our most up-to-date knowledge signifies that insiders personal lower than 1% of Corning Included. It’s a very giant firm, so it could be shocking to see insiders personal a big proportion of the corporate. Although their holding quantities to lower than 1%, we are able to see that board members collectively personal US$77m value of shares (at present costs). It’s good to see board members proudly owning shares, nevertheless it could be value checking if these insiders have been shopping for.

Common Public Possession

With a 20% possession, most of the people, principally comprising of particular person traders, have some extent of sway over Corning. Whereas this measurement of possession might not be sufficient to sway a coverage resolution of their favour, they’ll nonetheless make a collective influence on firm insurance policies.

Public Firm Possession

It seems to us that public corporations personal 9.5% of Corning. We will not be sure however it’s fairly attainable it is a strategic stake. The companies could also be related, or work collectively.

Subsequent Steps:

Whereas it’s properly value contemplating the completely different teams that personal an organization, there are different components which can be much more vital. To that finish, you have to be conscious of the 1 warning signal we have noticed with Corning .

In the end the long run is most vital. You may entry this free report on analyst forecasts for the corporate.

NB: Figures on this article are calculated utilizing knowledge from the final twelve months, which confer with the 12-month interval ending on the final date of the month the monetary assertion is dated. This might not be per full yr annual report figures.

Have suggestions on this text? Involved concerning the content material? Get in contact with us straight. Alternatively, electronic mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is common in nature. We offer commentary based mostly on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles are usually not meant to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your goals, or your monetary scenario. We intention to convey you long-term centered evaluation pushed by elementary knowledge. Word that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.

Be a part of A Paid Person Analysis Session

You’ll obtain a US$30 Amazon Reward card for 1 hour of your time whereas serving to us construct higher investing instruments for the person traders like your self. Join right here

Comments (0)