Telstra’s (ASX:TLS) Dividend Will Be Elevated To A$0.085

Telstra Company Restricted’s (ASX:TLS) dividend might be growing from final yr’s cost of the identical interval to A$0.085 on twenty second of September. This makes the dividend yield about the identical because the business common at 4.5%.

View our newest evaluation for Telstra

Telstra’s Cost Has Stable Earnings Protection

Until the funds are sustainable, the dividend yield doesn’t suggest an excessive amount of. Previous to this announcement, Telstra’s dividend made up fairly a big proportion of earnings however solely 50% of free money flows. This leaves loads of money for reinvestment into the enterprise.

The subsequent yr is ready to see EPS develop by 39.9%. Underneath the belief that the dividend will proceed alongside current developments, we expect the payout ratio may very well be 63% which might be fairly snug going to take the dividend ahead.

Dividend Volatility

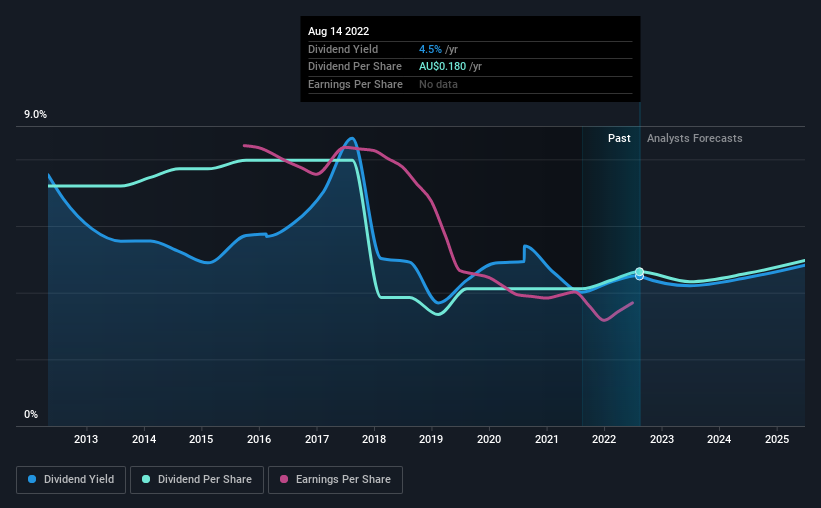

Whereas the corporate has been paying a dividend for a very long time, it has lower the dividend a minimum of as soon as within the final 10 years. Since 2012, the annual cost again then was A$0.28, in comparison with the latest full-year cost of A$0.18. The dividend has shrunk at round 4.3% a yr throughout that interval. An organization that decreases its dividend over time usually is not what we’re searching for.

The Dividend Has Restricted Development Potential

Provided that the dividend has been lower previously, we have to test if earnings are rising and if that may result in stronger dividends sooner or later. Over the previous 5 years, it seems as if Telstra’s EPS has declined at round 15% a yr. This steep decline can point out that the enterprise goes by means of a troublesome time, which may constrain its potential to pay a bigger dividend annually sooner or later. It isn’t all dangerous information although, because the earnings are predicted to rise over the following 12 months – we might simply be a bit cautious till this turns into a long run pattern.

In Abstract

General, that is most likely not an important earnings inventory, although the dividend is being raised for the time being. The funds have not been notably secure and we do not see enormous development potential, however with the dividend properly lined by money flows it may show to be dependable over the brief time period. We might be a contact cautious of counting on this inventory primarily for the dividend earnings.

Corporations possessing a secure dividend coverage will probably get pleasure from larger investor curiosity than these affected by a extra inconsistent strategy. On the similar time, there are different elements our readers ought to take heed to earlier than pouring capital right into a inventory. As an example, we have picked out 2 warning indicators for Telstra that buyers ought to think about. Is Telstra not fairly the chance you have been searching for? Why not take a look at our collection of prime dividend shares.

Have suggestions on this text? Involved in regards to the content material? Get in contact with us immediately. Alternatively, electronic mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is common in nature. We offer commentary based mostly on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles are usually not meant to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your goals, or your monetary scenario. We goal to convey you long-term centered evaluation pushed by basic knowledge. Be aware that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.

Be a part of A Paid Person Analysis Session

You’ll obtain a US$30 Amazon Reward card for 1 hour of your time whereas serving to us construct higher investing instruments for the person buyers like your self. Join right here

Comments (0)