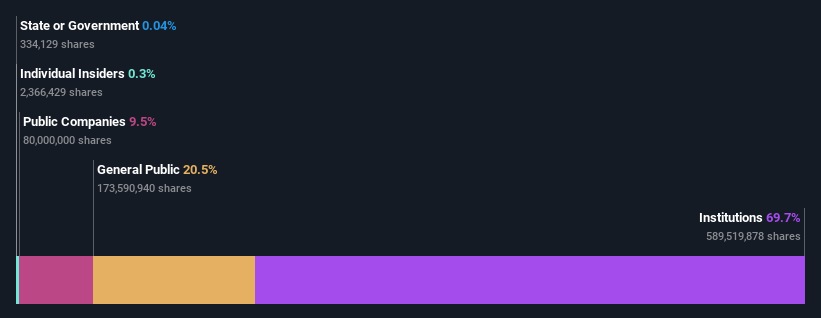

Corning Integrated (NYSE:GLW) is a favourite amongst institutional buyers who personal 70%

A have a look at the shareholders of Corning Integrated (NYSE:GLW) can inform us which group is strongest. With 70% stake, establishments possess the utmost shares within the firm. That’s, the group stands to learn probably the most if the inventory rises (or lose probably the most if there’s a downturn).

As a result of institutional homeowners have an enormous pool of sources and liquidity, their investing selections have a tendency to hold quite a lot of weight, particularly with particular person buyers. Because of this, a sizeable quantity of institutional cash invested in a agency is usually considered as a constructive attribute.

Let’s take a better look to see what the several types of shareholders can inform us about Corning.

Our evaluation signifies that GLW is probably undervalued!

What Does The Institutional Possession Inform Us About Corning?

Institutional buyers generally examine their very own returns to the returns of a generally adopted index. So they often do take into account shopping for bigger firms which can be included within the related benchmark index.

We are able to see that Corning does have institutional buyers; they usually maintain a very good portion of the corporate’s inventory. This suggests the analysts working for these establishments have appeared on the inventory they usually prefer it. However similar to anybody else, they could possibly be unsuitable. When a number of establishments personal a inventory, there’s all the time a danger that they’re in a ‘crowded commerce’. When such a commerce goes unsuitable, a number of events might compete to promote inventory quick. This danger is increased in an organization with no historical past of progress. You’ll be able to see Corning’s historic earnings and income under, however take into accout there’s all the time extra to the story.

Since institutional buyers personal greater than half the issued inventory, the board will seemingly have to concentrate to their preferences. Hedge funds haven’t got many shares in Corning. The Vanguard Group, Inc. is at the moment the most important shareholder, with 11% of shares excellent. In the meantime, the second and third largest shareholders, maintain 9.5% and 6.6%, of the shares excellent, respectively.

A more in-depth have a look at our possession figures means that the highest 16 shareholders have a mixed possession of fifty% implying that no single shareholder has a majority.

Whereas it is sensible to check institutional possession information for a corporation, it additionally is sensible to check analyst sentiments to know which manner the wind is blowing. Fairly a couple of analysts cowl the inventory, so you possibly can look into forecast progress fairly simply.

Insider Possession Of Corning

The definition of firm insiders might be subjective and does fluctuate between jurisdictions. Our information displays particular person insiders, capturing board members on the very least. The corporate administration reply to the board and the latter ought to symbolize the pursuits of shareholders. Notably, typically top-level managers are on the board themselves.

Most take into account insider possession a constructive as a result of it may point out the board is properly aligned with different shareholders. Nevertheless, on some events an excessive amount of energy is concentrated inside this group.

Our most up-to-date information signifies that insiders personal lower than 1% of Corning Integrated. Being so massive, we might not count on insiders to personal a big proportion of the inventory. Collectively, they personal US$78m of inventory. Arguably current shopping for and promoting is simply as necessary to think about. You’ll be able to click on right here to see if insiders have been shopping for or promoting.

Common Public Possession

Most of the people– together with retail buyers — personal 21% stake within the firm, and therefore cannot simply be ignored. This dimension of possession, whereas appreciable, will not be sufficient to alter firm coverage if the choice is just not in sync with different massive shareholders.

Public Firm Possession

We are able to see that public firms maintain 9.5% of the Corning shares on situation. We won’t be sure however it’s fairly attainable this can be a strategic stake. The companies could also be related, or work collectively.

Subsequent Steps:

Whereas it’s properly value contemplating the totally different teams that personal an organization, there are different elements which can be much more necessary. For instance, we have found 1 warning signal for Corning that try to be conscious of earlier than investing right here.

If you’re like me, you might need to take into consideration whether or not this firm will develop or shrink. Fortunately, you may examine this free report exhibiting analyst forecasts for its future.

NB: Figures on this article are calculated utilizing information from the final twelve months, which confer with the 12-month interval ending on the final date of the month the monetary assertion is dated. This will not be in line with full 12 months annual report figures.

Valuation is complicated, however we’re serving to make it easy.

Discover out whether or not Corning is probably over or undervalued by testing our complete evaluation, which incorporates honest worth estimates, dangers and warnings, dividends, insider transactions and monetary well being.

Have suggestions on this text? Involved in regards to the content material? Get in contact with us straight. Alternatively, e-mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is common in nature. We offer commentary primarily based on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles should not supposed to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your aims, or your monetary scenario. We intention to deliver you long-term centered evaluation pushed by elementary information. Notice that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.

Comments (0)