Those that invested in Telstra Group (ASX:TLS) 5 years in the past are up 43%

If you purchase and maintain a inventory for the long run, you positively need it to supply a optimistic return. Moreover, you’d typically prefer to see the share worth rise quicker than the market. However Telstra Group Restricted (ASX:TLS) has fallen wanting that second objective, with a share worth rise of 11% over 5 years, which is beneath the market return. The final yr has been disappointing, with the inventory worth down 2.8% in that point.

Now it is value taking a look on the firm’s fundamentals too, as a result of that can assist us decide if the long run shareholder return has matched the efficiency of the underlying enterprise.

See our newest evaluation for Telstra Group

To paraphrase Benjamin Graham: Over the brief time period the market is a voting machine, however over the long run it is a weighing balance. One approach to study how market sentiment has modified over time is to have a look at the interplay between an organization’s share worth and its earnings per share (EPS).

Throughout 5 years of share worth development, Telstra Group really noticed its EPS drop 15% per yr.

The sturdy decline in earnings per share suggests the market is not utilizing EPS to evaluate the corporate. On condition that EPS is down, however the share worth is up, it appears clear the market is focussed on different elements of the enterprise, in the intervening time.

We observe that the dividend has not elevated, so that does not appear to clarify the rise, both. And the income decline of -5.0% per yr may very well be seen as proof that Telstra Group is shrinking. So it isn’t clear to us why the share worth is up – a more in-depth inspection of the inventory may yield clues.

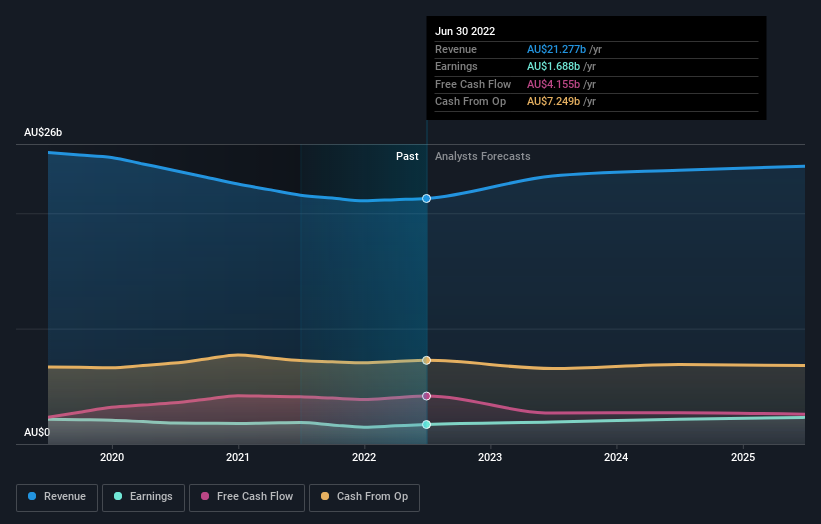

The corporate’s income and earnings (over time) are depicted within the picture beneath (click on to see the precise numbers).

We’re happy to report that the CEO is remunerated extra modestly than most CEOs at equally capitalized corporations. However whereas CEO remuneration is at all times value checking, the actually essential query is whether or not the corporate can develop earnings going ahead. So we suggest testing this free report exhibiting consensus forecasts

What About Dividends?

When funding returns, it is very important take into account the distinction between whole shareholder return (TSR) and share worth return. The TSR is a return calculation that accounts for the worth of money dividends (assuming that any dividend acquired was reinvested) and the calculated worth of any discounted capital raisings and spin-offs. It is honest to say that the TSR offers a extra full image for shares that pay a dividend. Within the case of Telstra Group, it has a TSR of 43% for the final 5 years. That exceeds its share worth return that we beforehand talked about. That is largely a results of its dividend funds!

A Completely different Perspective

We’re happy to report that Telstra Group shareholders have acquired a complete shareholder return of 1.3% over one yr. That is together with the dividend. Nonetheless, that falls wanting the 7% TSR each year it has made for shareholders, annually, over 5 years. The pessimistic view can be that be that the inventory has its finest days behind it, however alternatively the worth may merely be moderating whereas the enterprise itself continues to execute. Whereas it’s nicely value contemplating the completely different impacts that market situations can have on the share worth, there are different elements which might be much more essential. Even so, bear in mind that Telstra Group is exhibiting 2 warning indicators in our funding evaluation , you must find out about…

After all Telstra Group is probably not one of the best inventory to purchase. So it’s possible you’ll want to see this free assortment of development shares.

Please observe, the market returns quoted on this article replicate the market weighted common returns of shares that at the moment commerce on AU exchanges.

Have suggestions on this text? Involved concerning the content material? Get in contact with us instantly. Alternatively, e-mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is basic in nature. We offer commentary based mostly on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles are usually not meant to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your targets, or your monetary state of affairs. We goal to convey you long-term centered evaluation pushed by basic information. Word that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.

Be part of A Paid Consumer Analysis Session

You’ll obtain a US$30 Amazon Present card for 1 hour of your time whereas serving to us construct higher investing instruments for the person buyers like your self. Enroll right here

Comments (0)