Corning: We Provoke With A Impartial Ranking (NYSE:GLW)

John M. Chase/iStock Unreleased through Getty Photographs

Corning Integrated (NYSE:GLW) is a world chief in specialty glass and ceramics. It was previously often known as Corning Glass Works and was based in 1851. The corporate engages in panel show applied sciences, optical communications networks, environmental applied sciences (together with glass options for vehicles), specialty supplies, and life sciences companies. Within the Searching for Alpha neighborhood, the corporate may be very well-rated. Though our inside group is optimistic concerning the firm’s long-term objectives, we’re additionally extra cautious a few possible slowdown in shopper spending actions.

Certainly, trying on the divisional stage, show applied sciences and specialty supplies account for nearly 40% of the corporate’s complete income line and are divisions very a lot uncovered to shopper demand. Show Applied sciences’ margins had been again to development after a five-year interval of fixed decline. We’re extra optimistic concerning the car division and optical communications (each account for 42% of the entire firm’s turnover); nonetheless, decrease automobile manufacturing can be anticipated for 2023 and isn’t enjoying any favorable function in Corning’s income development.

Regardless of that, up to now, Corning was in a position to expertise income development even in a declining market. For example, between 2016 and 2021, smartphone quantity CAGR declined by 2%, whereas the corporate’s show section elevated top-line gross sales by 12%. The identical optimistic trajectory was recorded within the Vehicles division, the place Corning’s potential is targeted on its product MIX, which is in actual fact significantly larger than that of opponents; as well as, content material per automobile stands at $100, whereas up to now was at $50.

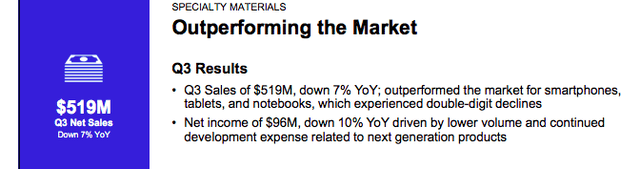

Corning outperforming the market

It’s also essential to focus on its technique execution known as “Extra Corning“. The corporate’s mental property and portfolio synergies needs to be a key supportive catalyst for long-term profitability. The glass chief is focusing on: 1) a shared manufacturing course of in its core expertise and a pair of) a typical gross sales platform inside its divisional segments. This could help economies of scale and scopes.

Q3 Outcomes

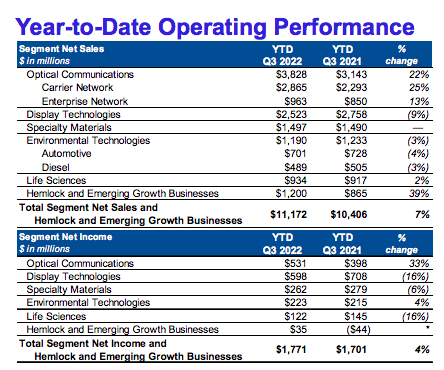

Corning simply launched its quarterly accounts. The corporate gross sales stood at $3.67 billion and had been up by 1% year-on-year. Cross-checking analyst consensus, turnover was barely above expectation, whereas EPS was in line. Concerning the principle division key takeaways, listed below are our primary issues:

- Show Applied sciences section turnover was at $686 million, down by 28% on a yearly foundation. In line with Corning, gross sales decreased in step with the market and the corporate was in a position to preserve flat costs;

- Optical Communications’ top-line gross sales stood at $1.32 billion and had been up by 16%. This was primarily as a consequence of broad-based power throughout cloud options, 5G, and broadband;

- As already talked about, Specialty Supplies gross sales had been under Wall Avenue analyst consensus and recorded $519 million in gross sales below 7% on a yearly foundation and lacking by virtually $100 million the typical estimates. This decrease demand was pushed by decrease shopper expenditures on tablets and smartphones.

- Each Environmental Applied sciences and Life Sciences gross sales had been up, respectively by 10% and a pair of% versus the identical interval final 12 months. The Healthcare division outcomes had been partially offset by a decremental demand for COVID-19 diagnostic options.

Corning 9M outcomes comps

Conclusion and Valuation

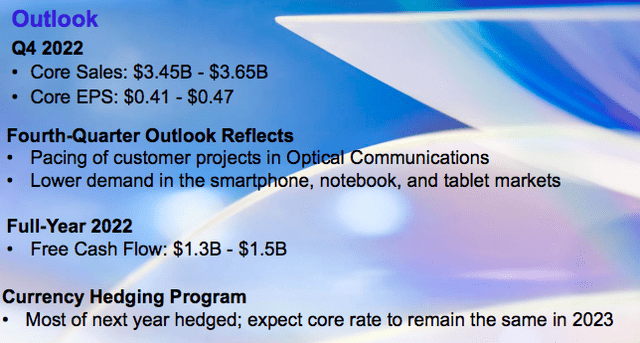

Gross margin was as soon as once more down. This was partially because of the decrease quantity within the Show division. Necessary to notice is the truth that the corporate is guiding for decrease income development in This autumn, together with a decline in Optical Communications gross sales. Right here on the Lab, we consider that the unfavorable inventory worth efficiency was extra because of the administration’s future indication than the Q3 outcomes. Certainly, evaluating Wall Avenue estimates, the typical This autumn income forecast was set at $3.85 billion with an EPS of $0.55, whereas Corning indicated a midpoint of $3.5 billion in gross sales and non-GAAP EPS between $0.41 and $0.47. For the above cause, we’re extra cautious in our 2023 Corning forecast and we’re projecting an EPS of $2.5 per share. We resolve to worth the entity with a 14x P/E on our 2023 quantity, reaching a valuation of $35 per share, and assigning a impartial score to the corporate. The principle dangers embrace FX, larger logistic prices, slower product demand, market share loss and better power costs.

Comments (0)